NOT

MEASUREMENT

SENSITIVE

DOE G 413.3-7A

Approved 1-12-2011

Chg 1 (Admin Chg) 10-22-2015

Risk Management Guide

[This Guide describes suggested non-mandatory approaches for meeting requirements. Guides

are not requirements documents and are not to be construed as requirements in any audit or

appraisal for compliance with the parent Policy, Order, Notice, or Manual.]

U.S. Department of Energy

Washington, D.C. 20585

AVAILABLE ONLINE AT: INITIATED BY:

https://www.directives.doe.gov Office of Project Management

Oversight & Assessments

DOE G 413.3-7A i (and ii)

1-12-2011

FOREWORD

This Department of Energy Guide is for use by all DOE elements. This Guide intends to provide

non-mandatory risk management approaches for implementing the requirements of DOE O

413.3B, Program and Project Management for the Acquisition of Capital Assets, dated 11-29-

2010. DOE programs may adopt other acceptable risk management approaches/methods as

determined appropriate for the type of project and program maturity by the line management for

the specific program. Guides are not requirement documents and should not be construed as

requirements. DOE Guides are part of the DOE Directives Program and provide suggested ways

of implementing Orders, Manuals, and other regulatory documents.

DOE G 413.3-7A iii

1-12-2011

TABLE OF CONTENTS

1.0 PURPOSE .................................................................................................................................1

2.0 SCOPE ......................................................................................................................................1

3.0 RISK MANAGEMENT ORGANIZATIONAL BREAKDOWN STRUCTURE, CONCEPT,

AND RESPONSIBILITIES .............................................................................................................2

3.1 Risk Management Organizational Breakdown Structure............................................................................ 2

3.2 Risk Management Organizational Concept ................................................................................................ 3

3.3 Risk Management Organizational Responsibilities .................................................................................... 4

3.3.1 Federal Project Director ......................................................................................................................... 5

3.3.2 Integrated Project Team ......................................................................................................................... 5

3.3.3 Contractor Project Manager ................................................................................................................... 6

3.3.4 DOE/National Nuclear Security Administration Headquarters ............................................................. 6

4.0 RISK MANAGEMENT PROCESS WITHIN THE PROJECT LIFE CYCLE .......................7

4.1 Project Phase Integration ............................................................................................................................ 7

4.2 Risk Planning.............................................................................................................................................. 9

4.3.1 Risk Identification ............................................................................................................................... 10

4.3.2 Assignment of the Risk Owner ............................................................................................................ 14

4.3.3 Assignment of Probability and Consequence ...................................................................................... 14

4.3.4 Assignment of Risk Trigger Metrics .................................................................................................... 15

4.3.5 Risk Register ........................................................................................................................................ 15

4.3.6 Risk Analysis ....................................................................................................................................... 16

4.4.1 Acceptance ........................................................................................................................................... 28

4.4.2 Avoidance/Exploit ............................................................................................................................... 28

4.4.3 Mitigation/Enhance .............................................................................................................................. 29

4.4.4 Transfer/Share ...................................................................................................................................... 30

4.6.1 Risk Monitoring Process Considerations ............................................................................................. 31

4.6.2 Risk Monitoring Methods .................................................................................................................... 32

5.0 RISK DOCUMENTATION AND COMMUNICATION ......................................................35

6.0 TAILORING OF RISK MANAGEMENT ...........................................................................399

7.0 APPLICATION OF CONTINGENCY AND MANAGEMENT RESERVE FOR NON-

M&O CONTRACTS .....................................................................................................................40

8.0 ATTACHMENTS .............................................................................................................

Attachment 1: Risk Breakdown Structure ................................................................................... 1-1

Attachment 2: Risk Status Report ................................................................................................ 2-1

Attachment 3: Risk Responsibility Assignment Matrix .............................................................. 3-1

Attachment 4: Probability Scale/Schedule Consequence Criteria ............................................... 4-1

Attachment 5: Risk Register ........................................................................................................ 5-1

Attachment 6: Cost/Benefit Analysis........................................................................................... 6-1

Attachment 7: Opportunity Matrix .............................................................................................. 7-1

Attachment 8: Risk Identification Checklist ................................................................................ 8-1

Attachment 9: Risk Monitoring Checklist ................................................................................... 9-1

Attachment 10: Management Reserve or Contingency Use Report .......................................... 10-1

Attachment 11: Risk Identification, Development and Use of Contingency and Management

Reserve ....................................................................................................................................... 11-1

Attachment 12: Cost and Schedule Contingency Development Process ................................... 12-1

Attachment 13: Contingency Estimate Inputs and Interface Needs (Supplementary Information)

.................................................................................................................................................... 13-1

iv DOE G 413.3-7A

1-12-2011

Attachment 14: Management and Reporting of MR and Contingency ..................................... 14-1

Attachment 15: Glossary............................................................................................................ 15-1

List of Appendices

APPENDIX A: REFERENCES .................................................................................................. A-1

List of Figures

Figure 1. Critical Decision Phases with Continuous and Iterative Risk Management ....................8

Figure 2. Risk Management Process. Linear Representation of the Continuous and Iterative

Process .............................................................................................................................9

Figure 3. Qualitative Risk Analysis Matrix ...................................................................................18

Figure 4. Total Project Cost Breakdown........................................................................................18

Figure 5. DOE and Contractor Performance Baseline ...................................................................18

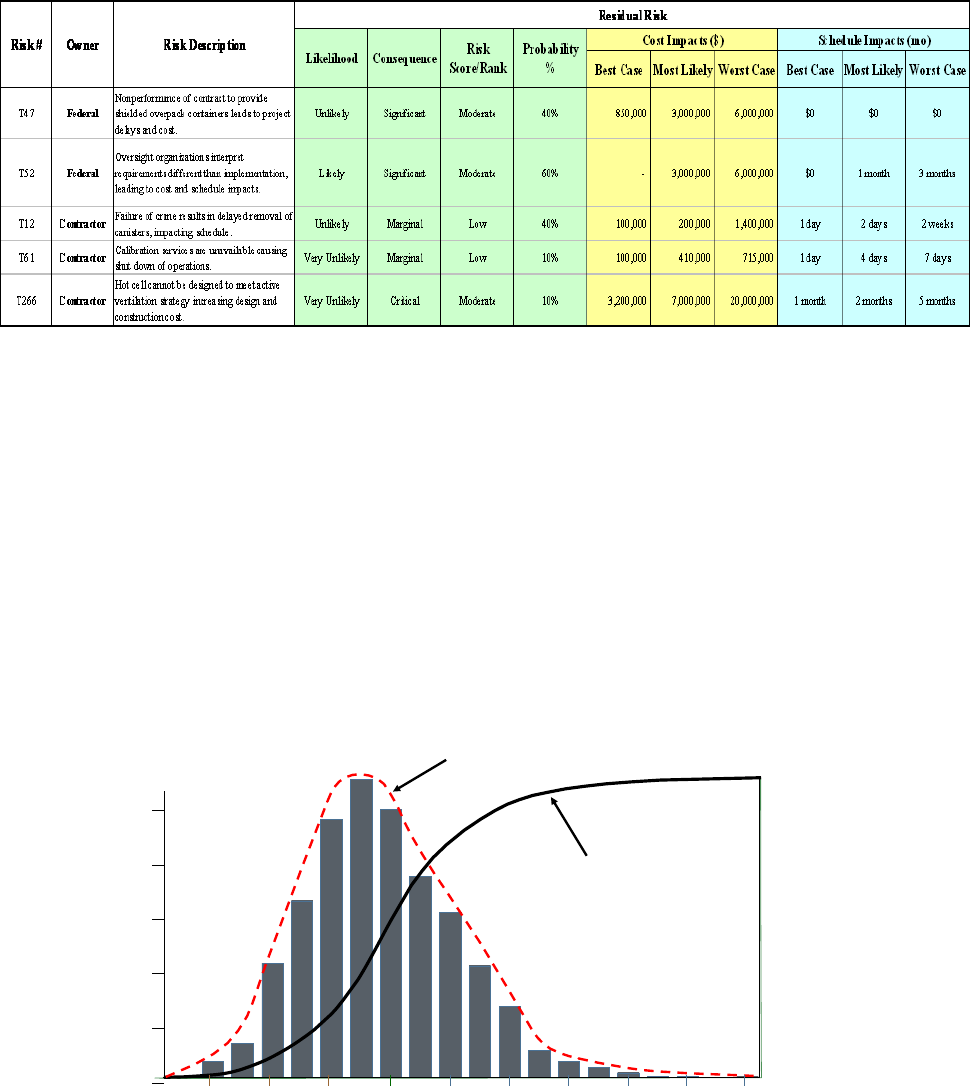

Figure 6. Example Output of Monte Carlo Analysis of Cost Risk Impacts ..................................18

DOE G 413.3-7A 1

1-12-2011

1.0 PURPOSE

The purpose of this guide is to describe effective risk management processes. The continuous

and iterative process includes updating project risk documents and the risk management plan and

emphasizes implementation communication of the risks and actions taken. The guidelines may

be tailored according to program guidance and the needs of projects. DOE programs may adopt

other acceptable risk management approaches/methods as determined appropriate for the type of

project and program maturity by the line management for the specific program. A program (e.g.,

Office of Science) that has a methodology to adequately govern risk management may continue

to use its own specific methodology.

This guide provides a suggested framework for identifying and managing key technical,

schedule, and cost risks and how it integrates with the development and consistent use of

government contingency and contractor management reserve. The DOE Order 413.3B states that

risk management is an essential element of every project.

Risk management for this purpose is the handling of risks through specific methods and

techniques within the bounds of project management. The definition of risk for this guide is a

factor, element, constraint, or course of action that introduces an uncertainty of outcome that

could impact project objectives. The risks to be handled should be comprised of threats and

opportunities. Threats are risks with negative consequences, and opportunities are risks with

positive benefits.

The suggested risk management process set forth in this guidance demonstrates a continuous and

iterative process. This framework meets the requirements of the Order to be forward looking,

structured, and informative. The issue of the establishment of technical design margins to

address the uncertainties or unknowns associated with the design is addressed in greater detail in

the DOE Guides

1

; however, the risk and its uncertainty arising from designs are addressed by

this Guide as are the necessities of increased technical oversight requirements. Further, this risk

management process has been developed to meet the overall monitoring and reporting

requirements, and to allow one to continue to monitor those technical uncertainties.

2.0 SCOPE

This guide may be used by all Department of Energy (DOE) offices and the National Nuclear

Security Administration (NNSA), their respective field operations, operations’ contractors, and

subcontractors as specified in their respective contracts.

This guide suggests processes for the initiation, planning, execution, monitoring, and close-out of

the risk management throughout the life cycle of the project. As such, the concepts and practices

in this guide may be tailored based upon:

1

For example: DOE G 413.3-1, Managing Design and Construction Using Systems Engineering, for use with DOE

O 413.3B, dated 11-29-2010.

2 DOE G 413.3-7A

1-12-2011

The project complexity.

The size and duration of the project.

The initial overall risk determination of the project.

The organizational risk procedures.

The available personnel and their skills levels for performing risk management.

The available relevant data and its validation.

The final determination for risk management tailoring should be with the Integrated Project

Team (IPT) or the Contractor Project Manager (CPM) as described in the project risk

management plan. Tailoring of the risk management process generally includes selection of what

risks to actively manage based on risk level, determination whether to perform a quantitative

analysis, types of analysis to be performed, communication plan requirements, and types and

frequency of reporting and monitoring.

This guidance and advice should be intended to meet, but should not be limited to, the following

objectives:

Identify the risk management processes.

Identify the steps necessary to facilitate the implementation of those processes.

Provide life-cycle risk management guidance.

Provide risk management documentation guidance.

Provide risk management monitoring and reporting guidance.

This guide should not be intended to replace assessment processes developed for nuclear safety

and environmental, safety, health, and quality (ESH&Q). It should also not be intended to

replace assessment processes developed for safeguards and security. This guidance also

recognizes the benefit and necessity of early consideration and integration of safety related

project risk into the project risk management process.

3.0 RISK MANAGEMENT ORGANIZATIONAL BREAKDOWN

STRUCTURE, CONCEPT, AND RESPONSIBILITIES

3.1 Risk Management Organizational Breakdown Structure

Using the organizational breakdown structure (OBS) in the Project Execution Plan (PEP) or

Project Management Plan (PMP), the risk management team should be identified along with

DOE G 413.3-7A 3

1-12-2011

roles and responsibilities of the team members. Whenever the PEP or PMP is updated, the risk

management plan should also be updated, if changes have been made to the OBS.

The organizational breakdown structure should serve three purposes in risk management. These

purposes, as well as illustrations for each purpose, are shown as follows:

Highlights the chain of authority, communication structure, and management framework

with which risk management and the decision processes will occur.

- Assists with identifying organizational risks and/or external risks.

- Assists with identifying where certain risk management ownership and decision

processes reside.

- Reduces time for critical risk communication.

- Allows for documentation of risk communication chain.

Provides a means to map risks organizationally to determine where the greatest number

of risks resides and/or the highest-rated risks reside.

- Can provide a format for the development of a Risk Breakdown Structure (see

Attachment 1, Risk Breakdown Structure).

- Provides a means of identifying risk owners.

The risk management organizational structure assists in integrating risk management into the

procedures and processes of the organization. It also assists in developing the responsibility

assignment matrix for key risk management roles and responsibilities in a structured and formal

manner, and facilitates the communication process suggested in this guide. It provides a means to

link the risk breakdown structure with the organization for risk management to determine where

the risks reside and who is responsible for them.

3.2 Risk Management Organizational Concept

Programs and projects are of varied types and of differing complexity. The risks may span

multiple levels of organizational management, crosscut multiple organizations, and/or crosscut

different sites within the complex. For risk management to be effective, it should be an integral

part of the organization’s corporate enterprises-governance (e.g., standards, procedures,

directives, policies, and other management documentation).

In order to implement the risk management principles

2

and processes successfully, an

organizational process perspective should be considered within which the risk management

2

OMB M-07-24, Memorandum for the Heads of Executive Departments and Agencies, ―Updated Principles for

Risk Analysis,‖ September 19, 2007. (Text cited only for the universal risk management principles and not the

context they are presented within the memo.)

4 DOE G 413.3-7A

1-12-2011

processes could operate. The processes and procedures, along with applicable tools to be used for

performing risk management functions should be carefully considered, established, and well

defined when implemented. The risk management processes described later in this guide should

be carefully tailored to involve and meet the needs of the organization’s internal planning,

assessment, project controls, risk monitoring, reporting, and decision-making processes at the

different levels of risk management.

A clearly defined integrated risk management framework should consider the structure and

interactions of the management organization(s) and management levels. These should be charted

or mapped out and institutionalized (process-wise) in order to help:

Align the organization(s) to accomplish the mission, in concert with the established

requirements, policies, strategic plans, roles and responsibilities aligned via clearly

defined and well-understood processes and procedures. This alignment should be done in

order to meet the goals and objectives of the Department at all levels of the

organization(s) supported by risk management-based decision making knowledge.

Increase the interaction and communication between upper management and functional

contributors, and to better understand all types of project risks, such as: political,

economic, social, and technological, policy, program, project, financial, resource-based,

health and safety, safeguards and security, and operational. Without this interaction,

identification of risks and the communication and handling of risks cannot be adequately

accomplished, or be well understood.

Apply a consistent integrated systematic risk management process approach at all levels

of risk management to support decision-making and encourage better understanding and

application of the risk management process. For example, the same risk can exist in

different organizational levels such as the contractor, the site DOE Offices, and Program

Headquarters (HQ) Offices. This risk may be shared by all of the organizations and may

be managed by all utilizing different perspectives. This risk can also be within the same

site and crosscut and affect other capital, cleanup, information technology, or operating

projects, etc.

Build a culture that fosters risk management related learning, innovation, due diligence,

responsible leadership, management participation and involvement, lessons learned,

continuous improvement, and successive knowledge transfer.

The risk management framework should be completely integrated into the procedures and

processes of the organization. The risk management processes and procedures should be

supported by management through self-assessments, lessons learned, and a continuous

improvement environment.

3.3 Risk Management Organizational Responsibilities

The key roles, roles which have a significant impact upon the risk management of the project,

and responsibilities are the highest level of project risk authority and responsibility. A complete

DOE G 413.3-7A 5

1-12-2011

responsibility assignment matrix for risk management roles and responsibilities should be

included in the risk management plan.

3.3.1 Federal Project Director

As per DOE O 413.3B, the Federal Project Director (FPD) is responsible for leading the IPT.

Throughout the project life cycle, the FPD should:

Apply a continuous, iterative risk management process.

Document and manage risks.

Develop, maintain, and provide required risk documentation, and report to appropriate

project and program management personnel. This includes providing configuration

management for this documentation.

Ensure a tailored approach to risk management.

Ensure that the sponsoring program office continues to be informed of the status of

project risks with potentially large cost and schedule impacts as soon as they are

recognized.

Formally accept or reject any risks that are proposed to be transferred from the

contractor to the federal government (DOE or NNSA).

Oversee acceptance and closure of risks owned by the FPD.

Oversee the roles and responsibilities of each IPT member with respect to risk

management.

Coordinate with the project’s Contracting Officer early in the acquisition process and

throughout the project for contract-related risks.

Serve as the focal point of communication between the contractor and DOE-HQ for all

risk-related issues.

Develop an environment in which lessons learned are encouraged from project

experience and risk management, and develop new lessons learned as appropriate.

3.3.2 Integrated Project Team

Throughout the project life cycle, the IPT, in support of the FPD, should:

3

Apply the continuous risk management process.

3

Additional information on the IPT roles and responsibilities is provided in DOE Guide 413.3-18, Integrated

Project Team Guide.

6 DOE G 413.3-7A

1-12-2011

Document and manage the risk management process contained within the risk

management plan and the risk management communication plan (see Section 5.3, Risk

Management Communication Plan).

Provide documentation and management of risks throughout the project life cycle via the

project risk register (see Section 4.3.5, Risk Register, and Attachment 1, Risk

Breakdown Structure).

Develop and provide the project risk status report (see Attachment 2, Risk Status

Report) to management.

3.3.3 Contractor Project Manager

For non-M&O contracts, the CPM manages risks under the Contract Budget Base (see

Attachment 11, Figure A-1) independently subject to the requirements set in the procurement

contract. The risk management responsibilities of the CPM, unless otherwise directed by the

contract terms and conditions as they bound the project life cycle, should be to: (see Section 7

and Attachments 11-14 for a discussion on contractor’s risks and their management under the

Contract Budget Base)

Apply a continuous, iterative risk management process for all contractor risks.

Document and manage contractor risks and transfer to the Government, with FPD

concurrence, risks that are not the contractor’s responsibility.

Develop, maintain, and provide required risk documentation (using configuration

management) and reporting to appropriate project and program management personnel.

This includes providing configuration management for this documentation.

Ensure the project’s Contracting Officer continues to be informed of the change control

process and that the supporting documentation is generated for managing risks within

the Contract Budget Base.

Coordinate with the FPD in the development of a tailored approach to overall project

risk management.

Coordinate with the FPD in the process of recognition, acceptance and closure of key

project risks.

3.3.4 DOE/National Nuclear Security Administration Headquarters

Headquarters program office personnel should:

Provide guidance on the risk management process.

Provide support to site office programs in the evaluation, analysis, assessment, and

reporting of risk.

DOE G 413.3-7A 7

1-12-2011

Provide support to site office programs for training and education in risk management.

Facilitate information sharing on risk management best practices, trends, and

publications.

Interface with the FPD and IPT for risk.

4.0 RISK MANAGEMENT PROCESS WITHIN THE PROJECT LIFE

CYCLE

4.1 Project Phase Integration

This risk management guide is integrated with DOE O 413.3B, but it also suggests process steps

beyond those stated in DOE O 413.3B in some specific instances, such as the Risk Register. The

risk management process is a continuous, iterative process that is performed as early in the

project life cycle as possible.

Wherever possible, the project phases in DOE O 413.3B should be aligned with the risk

management process to allow an integrated view (Figure 1). Figure 1 provides a view of the

steps of the risk management process against the Critical Decision Phases of a project. While this

view presents a static view of risk management, it is not meant to infer that the process is static.

Instead it is meant to demonstrate when one should initiate for the first time certain process

steps.

The risk management plan should be included in or referenced in the preliminary project

execution plan during CD-1 (see Section 5.2, Risk Management Plan).

8 DOE G 413.3-7A

1-12-2011

Figure 1. Critical Decision Phases with Continuous and Iterative Risk Management

While the process flow appears linear, the process itself is iterative and not necessarily

consecutive. The risk planning step, for example, is continuous throughout the project life cycle,

as is the need for risk communication and documentation. The pattern that is represented by the

linear process diagram (Figure 2) demonstrates that certain steps generally precede others;

however, as the project proceeds, the review processes do not necessarily progress in the same

manner.

DOE G 413.3-7A 9

1-12-2011

Figure 2. Risk Management Process. Linear Representation

of the Continuous and Iterative Process

4.2 Risk Planning

The risk planning process should begin as early in the project life cycle as possible. Planning sets

the stage and tone for risk management and involves many critical initial decisions that should be

documented and organized for interactive strategy development.

Risk planning is conducted by the IPT

4

(if assembled by this time) and a FPD or an assigned lead

federal employee if the FPD is not yet assigned. Risk planning should establish methods to

manage risks, including metrics and other mechanisms or determining and documenting

modifications to those metrics and mechanisms. A communication structure should be developed

to determine whether a formal risk management communication plan should be written and

executed as part of the tailoring decisions to be made in regard to the project (see Section 5.3,

Risk Management Communication Plan, and Section 6.0, Tailoring of Risk Management). Input

to the risk planning process includes the project objectives, assumptions, mission need statement,

customer/stakeholder expectations, and site office risk management policies and practices.

The team should also establish what resources, both human and material, would be required for

successful risk management on the project. Further, an initial reporting structure and

documentation format should also be established for the project.

4

For a discussion and guidance on the types of skill sets (which include Subject Matter Experts in Risk

Management) that should be represented on an IPT see DOE G 413.3-18, Integrated Project Teams Guide, dated

9-24-08.

Feedback

Risk

Planning

Risk

Assessment

Risk

Handling

Risk

Monitoring

Risk

Identification

Risk

Analysis

Risk Documentation

10 DOE G 413.3-7A

1-12-2011

Overall objectives for risk planning should:

Establish the overall risk nature of the project including recognizing the relative

importance of the project to the office with the DOE or the NNSA (to include its priority

ranking within the organization).

Establish the overall experience and project knowledge desired of the IPT.

Establish the technical background and risk knowledge desired of the IPT.

An initial responsibility assignment matrix with roles and responsibilities for various risk

management tasks should be developed (see Attachment 3, Risk Responsibility Assignment

Matrix). Through this Responsibility Assignment Matrix, gaps in expertise should be identified

and plans to acquire that expertise should be developed.

The result of the risk planning process is the Risk Management Plan (see Section 5.2, Risk

Management Plan). The Risk Management Plan (RMP) ties together all the components of risk

management – i.e., risk identification, analysis and mitigation – into a functional whole. The plan

is an integral part of the project plan that informs all members of the project team and

stakeholders how risk will be managed, and who will manage them throughout the life of the

project. It should be part of the initial project approval package. A companion to the RMP is a

Risk Register which is updated continuously and used as a day-to-day guide by the project team.

4.3 Risk Assessment

Risk assessment includes the overall processes of risk identification and analysis. The risk

assessment process identifies, analyzes, and quantifies potential program and project risks in

terms of probability and consequences. Risk analysis is a technical and systematic process that is

designed to examine risks, identify assumptions regarding those risks, identify potential causes

for those risks, and determine any relationships to other identified risks, as well as stating the

overall risk factor in terms of the probability and consequence, if the risk should occur. Risk

identification and analysis are performed sequentially with identification being the first step (see

Attachment 5, Risk Register).

4.3.1 Risk Identification

As with each step in the risk management process, risk identification should be done

continuously throughout the project life cycle. As projects change—particularly in terms of

budget, schedule, or scope—or when a mandatory review or update is required, the risk

identification process should be iterated, at least in part. Post CD-1, the Risk Register should be

evaluated at least quarterly.

To begin risk identification, break the project elements into a risk breakdown structure that is the

hierarchical structuring of risks. The risk breakdown structure is a structured and organized

method to present the project risks and to allow for an understanding of those risks in one or

more hierarchical manners to demonstrate the most likely source of the risk. The risk breakdown

structure provides an organized list of risks that represents a coherent portrayal of project risk

DOE G 413.3-7A 11

1-12-2011

and lends itself to a broader risk analysis. The upper levels of the structure can be set to project,

technical, external, and internal risks; the second tier can be set to cost, schedule, and scope.

Each tier can be broken down further as it makes sense for the project and lends itself to the next

step of risk analysis. To be useful, the risk breakdown structure should have at least three tiers.

Such a breakdown is just one methodology, as the type of project or project organization may

dictate the best risk breakdown structure to apply. Templates for project types may be found in

the literature for software projects, construction projects, and others; however, these templates

should be modified based upon the specifics of the project being undertaken. The reason for this

statement is that the taxonomy to be used is often project specific and scope dependent (see

Attachment 1, Risk Breakdown Structure).

Whenever using the Risk Breakdown Structure, it is important to remember to consider the use

of a category called ―other.‖ This category will promote further brainstorming during the process

and provide another opportunity for risk identification.

The risk breakdown structure can be used to inform the following:

Updates of the risk management plan.

Work breakdown structure.

Cost estimates.

Key planning assumptions.

Preliminary schedules.

Acquisition strategy documents.

Technology Readiness Assessment (TRA) information.

Project Definition Rating Index (PDRI) analyses.

Safety-in Design considerations per DOE-STD-1189-2008.

Safety analysis assumptions.

Environmental considerations such as seismic, wind and flooding.

Safeguards and security analysis assumptions.

Requirements documents or databases.

Subject matter expert interviews.

Stakeholder input.

12 DOE G 413.3-7A

1-12-2011

Designs or specifications.

Historical records.

Lessons learned.

Any legislative language pertaining to the project.

Other similar projects.

Pertinent published materials.

Various techniques that can be used to elicit risks include brainstorming, interviews and diagram

techniques. Regardless of the technique, the result should not be limiting and should involve the

greatest number of knowledgeable participants that can be accommodated within their

constraints. In addition, the participants need to address risks that affect the project but are

outside of the project ability to control. Examples include:

Closure of Waste Isolation Pilot Plant.

National repository not ready.

Congressional funding reductions.

DOE funding reductions.

Re-programming.

Stakeholder changes.

Site mission changes.

Regulatory and Statutory changes.

DOE directives.

Once the process of initial risk identification is completed, the IPT should follow up with the

self-assessment process noted in Section 4.7.2.2, Self Assessment, using the Risk Identification

Checklist in Attachment 8.

As the team identifies risks, it is important that they are aware of biases that may influence the

information. Typical biases the facilitator of the risk identification should be aware of include the

following:

Status quo—strong bias toward risks already identified.

DOE G 413.3-7A 13

1-12-2011

Confirming evidence bias—information that supports existing points of view are

championed while avoiding information that contradicts.

Anchoring—disproportionate weight is given to the first information provided.

Sunk cost—tend to make choices in a way that justify past choices, unwillingness to

change direction.

When identifying a risk, it should be stated clearly in terms of both the risk event and the

consequences to the project. The format for the risk identified should generally be

cause/risk/effect.

One may choose to record cause, risk, and effect in separate fields to facilitate grouping of risks

into categories based on commonality of these attributes.

This format should be employed whether the risk is a threat to the project or an opportunity,

which is a risk with a benefit. Documentation should be done in affirmative terms—as if the risk

will occur—to enable the IPT to draft a definitive risk handling strategy. The information should

be captured in a risk register to facilitate tracking and reporting (see Attachment 1, Risk

Breakdown Structure).

Examples of risks captured in the affirmative are:

Discovery of classified material in landfill delays removal of transuranic material and

impacts schedule resulting in higher than expected project costs.

Delay in signing a cooperative research and development agreement impacts availability

of specialized research personnel in statistical analysis of nano-scale stress data of

carbon-based metals, delaying project by one year resulting in higher than expected

project costs.

Seismic site analysis area is expanded due to adjacent construction site seismic reports,

resulting in new drilling and reporting that delays site preparation by six months

resulting in higher than expected project costs.

Project complexity and size limits the number of contractor proposals competing for the

work, project costs are based on a limited number of proposals for work, resulting in

higher than expected project costs.

Risks should be linked to activities or Work Breakdown Structure as much as possible. The

linkage is important, especially if the risk owner is different as the risk owners may need to

coordinate their efforts on the risk handling strategies.

The IPT should capture both opportunities and threats. Opportunities are often shared between

and among projects. It should be noted that opportunities for one participant could be detrimental

to another; therefore, they should be worked cooperatively. Examples of opportunities include:

14 DOE G 413.3-7A

1-12-2011

Available human resources with flexible scheduling can be shared to the advantage of

two or more projects.

A crane is available at another site at a lower cost than purchasing a new or a used one.

Additional bench scale testing shows that the process flowsheet can be simplified.

In addition to identifying a risk in terms of the causal event and consequence, the pertinent

assumptions regarding that risk should be captured in the risk register to aid in future reporting of

the risk. These assumptions might include items such as, but not limited to, interfaces among and

between sites, projects, agencies, and other entities; dependencies on human resources,

equipment, facilities, or other; and historically known items that may impact the project either

positively or negatively. The assumptions should be kept current and should be validated through

various methods including documentation and subject matter experts.

4.3.2 Assignment of the Risk Owner

Before assigning a qualitative assessment to the dimensions of a risk (probability and

consequence), a risk owner should be identified. The risk owner is the team member responsible

for managing a specific risk from risk identification to risk closeout, and should ensure that

effective handling responses or strategies are developed and implemented, and should file

appropriate reports on the risk in a timely fashion. The risk owner should also validate the

qualitative and quantitative assessments assigned to their risk. Finally, the risk owner should

ensure that risk assumptions are captured in the risk register for future reference and assessment

of the risk and to assist possible risk transfer in the future.

Any action taken in regard to a risk should be validated with the risk owner before closure on

that action can be taken.

4.3.3 Assignment of Probability and Consequence

Risk analysis has two dimensions—probability and consequence. Probability is the likelihood of

an event occurring, expressed as a qualitative and/or quantitative metric. Consequence is the

outcome of an event. The outcome of an event may include cost and/or schedule impacts. The

initial assessments should assume that no risk handling strategy has been developed (see Section

4.3.6.1, Qualitative Risk Analysis and Section 4.3.6.3, Project Learning Analysis). After the risk

mitigation approach is identified and a decision made to implement the mitigation, the mitigation

cost becomes part of the line item cost and not the contingency. Only the remaining residual risk

should be included in the risk register and contingency analysis. During the qualitative analysis,

the probability and consequence scales can be categorical. However, it is often useful to assign

quantitative metrics to the qualitative categories to help ensure consistent assignment of

probabilities and consequences across a project (see Attachment 4, Probability Scale/Schedule

Consequence Criteria). This approach works well for probability and consequence.

DOE G 413.3-7A 15

1-12-2011

4.3.4 Assignment of Risk Trigger Metrics

A risk trigger metric is an event, occurrence or sequence of events that indicates that a risk may

be about to occur, or the pre-step for the risk indicating that the risk will be initiated. The risk

trigger metric is assigned to the risk at the time the risk is identified and entered into the risk

register. The trigger metric is then assigned a date that would allow both the risk owner and the

FPD to monitor the trigger. The purpose of monitoring the trigger is to allow adequate

preparation for the initiation of the risk handling strategy and to verify that there is adequate cost

and schedule to implement the risk handling strategy.

4.3.5 Risk Register

The risk register is the information repository for each identified risk. It provides a common,

uniform format to present the identified risks. The level of risk detail may vary depending upon

the complexity of the project and the overall risk level presented by the project as determined

initially at the initiation phase of the project.

The fields stated here are those that should appear in the risk register, whether the risks presented

are a threat or an opportunity. Other fields that are suggested to be considered are contained in

Attachment 5, Risk Register, and are suggested to be included as they allow a much better view

of the full field of options available:

Project title and code (denotes how the project is captured in the tracking system used by

the site office and/or contractor).

Unique risk identifier (determined by the individual site).

Risk statement (consider separate sub-fields to capture cause/risk/effect format to

facilitate automated search capabilities on common causes of risks).

Risk category (project, technical, internal, external, and any sub-category that may be

deemed unique to the project such as safety or environment).

Risk owner.

Risk assumptions.

Probability of risk occurrence and basis.

Consequence of risk occurrence and basis.

Risk cause/effect.

Trigger event.

Handling strategy (type and step-wise approach with metrics, who has the action,

planned dates, and actual completion dates). Include the probability of success for the

16 DOE G 413.3-7A

1-12-2011

risk handling strategy and consider probabilistic branching to account for the handling

strategy failing.

Success metric for overall handling strategy.

Residual risks.

Secondary risks.

Status (open/closed) and basis.

The risk register may also include back-up strategies for primary risks, risk handling strategies

for residual and secondary risks, the dates of upcoming or previous risk reviews, and a comment

section for historical documentation, lessons learned, and subject matter experts’ input.

4.3.6 Risk Analysis

Risk analysis should begin as early in the project life cycle as possible. The simplest analysis is a

cost and benefit review, a type of qualitative review. The qualitative approach involves listing

the presumed overall range of costs over the presumed range of costs for projected benefits. The

result would be a high level overall assessment of the risks on the project (see Attachment 6,

Cost/Benefit Analysis, for an alternative quantitative approach that can be used when enough

information is available).

After CD-1 approval, two forms of risk analysis may be performed: Qualitative and quantitative.

These analyses serve as the foundation for continuing dialog about future risk realizations and

the need for the application of the contingency and management reserve, which are subjects

addressed in other DOE G 413.3-series guides that handle cost and contingency calculations.

4.3.6.1 Qualitative Risk Analysis

The purpose of qualitative risk analysis is to provide a comprehensive understanding of known

risks for prioritization on the project. Qualitative risk assessment calls for several risk

characteristics to be estimated:

Assumptions.

Risk probability.

Risk consequence.

Trigger metrics or conditions.

Affected project elements.

Others, as appropriate.

DOE G 413.3-7A 17

1-12-2011

These items should be captured in the risk register. The initial qualitative assessment is done

without considering any mitigation of the risk, that is, prior to the implementation of a handling

strategy.

Qualitative analysis, or assessment as it is sometimes referred, is the attempt to adequately

characterize risk in words to enable the development of an appropriate risk handling strategy.

Additionally, qualitative analysis assigns a risk rating to each risk, which allows for a risk

grouping process to occur. This grouping of risks may identify patterns of risk on the project.

The patterns are indicative of the areas of risk exposure on the project. The qualitative analysis

may be the foundation for initiating the quantitative risk analysis, if required.

4.3.6.1.1 Qualitative Matrices Analysis

One of the tools used to assign risk ratings is a qualitative risk analysis matrix, also referred to as

a probability impact diagram or matrix (see Figure 3, Qualitative Risk Analysis Matrix). Risk

ratings are also often referred to as risk impact scores. The matrix shown in Figure 3 is an

example of the tool and could be modified by site and contractor, or any other category as

required.

The matrix combines the probability and consequence of a risk to identify a risk rating for each

individual risk. Each of these risk ratings represents a judgment as to the relative risk to the

project and categorizes at a minimum, each risk as low, moderate or high. Based on these risk

ratings, key risks, risk handling strategies, and risk communication strategies can be identified.

18 DOE G 413.3-7A

1-12-2011

Figure 3. Qualitative Risk Analysis Matrix.

Note: Matrix is suggested only, as each site may have a site-specific matrix.

Consequence

Probability

Negligible

Marginal

Significant

Critical

Crisis

Cost

Minimal or no

consequence.

No impact to

Project cost.

Small increase

in meeting

objectives.

Marginally

increases costs.

Significant

degradation in

meeting objectives

significantly

increases cost; fee

is at risk.

Goals and objectives are

not achievable.

Additional funding may

be required; loss of fee

and/or fines and

penalties imposed.

Project stopped.

Funding withdrawal;

withdrawal of scope,

or severe contractor

cost performance

issues.

Schedule

Minimal or no

consequence.

No impact to

Project

schedule.

Small increase

in meeting

objectives.

Marginally

impacts

schedule.

Significant

degradation in

meeting objectives,

significantly

impacts schedule.

Goals and objectives are

not achievable.

Additional time may

need to be allocated.

Missed incentivized

and/or regulatory

milestones.

Project stopped.

Withdrawal of scope

or severe contractor

schedule performance

issues.

Very High

>90%

Low

Moderate

High

High

High

High

75% to 90%

Low

Moderate

Moderate

High

High

Moderate

26% to 74%

Low

Low

Moderate

Moderate

High

Low

10% to 25%

Low

Low

Low

Moderate

Moderate

Very Low

<10%

Low

Low

Low

Low

Moderate

DOE G 413.3-7A 19

1-12-2011

As with a threat, an opportunity should also be assessed using a risk assessment framework (see

Attachment 7 for an example of an opportunity matrix). Risk ratings should be assigned via a

matrix to the risk, threat or opportunity, based upon the risk classification. Typical risk

classifications are low, moderate, or high. Another option could be to use numerical values for

ratings. The numerical value could be tailored to the project or standardized for a program.

Risks that have a determinative impact upon project cost or schedule will generally rate towards

the higher end of the qualitative scale. However, there may be little or no correlation between a

risk’s determinative impact and the qualitative risk rating, so caution with the lowest rated risks

in the qualitative analysis.

Care should be taken when comparing project risk scores of different projects as the project risk

scores are a result of a subjective process and are prepared by different project teams.

Qualitative risk analysis could also be performed on residual risks and secondary risks, but only

after the handling strategy has been determined for the primary risk. Again, the risk owner

should validate and accept the risk rating.

As the information is gathered and finalized, the data should be analyzed for bias and perception

errors. While the data will not be systematically used for a quantitative analysis, it should still be

analyzed and perceptions scrutinized.

Following the completion of the qualitative analysis, one should do a review of Section 4.3.6.3,

Project Learning Analysis.

4.3.6.1.2 Other Qualitative Techniques

One qualitative technique that may be used is to search on the risk register for common causes of

risks. By looking for risks with common causes, one can attempt to find opportunities within the

handling responses or strategies as well as commonalities in monitoring triggers, risk owners, or

other shared items. Further, it may be that changes can be made to the scope to avoid the risks

that were not apparent when viewing the risks individually.

Another qualitative technique for analyzing risks is to use a network diagram. Using a network

diagram to show what tasks bear the high and moderate risks and where they exist in regard to

the critical path can be a powerful tool in analyzing how much contingency should be set aside

for the risk to ensure that the critical path is not impacted or the risk to the critical path is within

a manageable range for the FPD. The diagram is used to determine the impact to successor tasks,

especially those that either impact the critical path directly or will have an impact upon a critical

input to the critical path.

The risk breakdown structure methodology provides the option of demonstrating patterns of risk

placement or risk groupings. For instance, rather than specifying the risk, the risk is captured as a

mark on the grid and grouped together, then cut across with another matrix technique such as the

work breakdown structure or the cost breakdown structure. (See reference – Hillson, D. A.

(2007), ―Understanding risk exposure using multiple hierarchies,‖ published as part of 2007 PMI

Global Congress EMEA Proceedings – Budapest).

20 DOE G 413.3-7A

1-12-2011

The risk is mapped to the work breakdown structure element that would be impacted if it

occurred. The pattern that emerges allows one to either use the assigned expected value score or

to count the number of risks associated with the element. This method allows attention to be

focused on specific areas of risks.

Again, a review of Section 4.3.6.3, Project Learning Analysis, should be done.

4.3.6.2 Quantitative Risk Analysis

Quantitative risk analysis should be used to estimate the impact of risks on project cost and

schedule. Quantitative risk analysis is a numerical or more objective analysis of the probability

and consequence of individual risks that also addresses the extent of the overall project risk

through the use of a model. The purpose of the quantitative risk analysis is to provide budget and

completion date estimates of the effect of the risks on the project using statistical modeling

techniques such as Monte Carlo, Quasi-Monte Carlo, sensitivity simulations, and other stochastic

methodologies, depending upon the project data. The simulation produces a Probability

Distribution Function (PDF) for a range of possible project outcomes and a Cumulative

Distribution Function (CDF) that represents the likelihood that a given probability the project

cost or duration will be at or below a given value (see Attachment 12, Cost and Schedule

Contingency Development Process, Figure A-3). Quantitative risk analysis could provide a view

of which risks or groups of risks should receive more focused attention. It allows a numerical

evaluation of risk on the project at a point in time. The simulations could also assist in projecting

the future cost and schedule of the project, if no other actions are taken, as well as allow for

projections to be run based on options the project could implement. Quantitative analysis could

also provide a method to determine the level of cost contingency, management reserve, schedule

contingency, and schedule reserve, when combined with cost uncertainty calculations, that is

required to complete the project within the level of confidence required by the DOE or NNSA

program office.

In general, quantitative analysis is an attempt to determine how much combined risk the project

contains and where and when that risk exists to enable the project team to focus the project

resources appropriately. Quantitative risk analysis has in the past been reserved for multi-year,

large, and/or complex projects or projects where the program or executive management desires a

more informed decision as to the amount of risk that exists on the project. Some DOE offices

allow for tailoring with respect to quantitative risk analysis. The reason for this type of tailoring

is that quantitative analysis allows for the use of different scenarios and alternatives to the base

case. However, for overall low risk projects, as determined by the qualitative analysis, it may be

determined that quantitative analysis is not warranted.

Quantitative analysis, when done, could be restricted to only those risks that are ranked higher

than low as the overall risk ranking from the qualitative analysis process. When this is done, the

magnitude of the underestimation should be addressed. The critical path for the project and the

approved budget serve as the primary basis for the risk model and for the project analysis.

It is important to model both risk threats and opportunities. It is suggested that the two types of

risk are modeled separately to allow for separate analysis given the different project impacts that

the two forms may have.

DOE G 413.3-7A 21

1-12-2011

4.3.6.2.1 Quantifying Probabilities and Impacts for Quantitative Risk Analysis

A complete and well executed qualitative analysis is essential to a quantitative analysis. It will

serve as the base for developing the data for input into a simulation model for quantitative

analysis.

For each risk, a percent or percentage distribution is assigned to the probability (how likely it is

the risk will occur), a dollar value or dollar value distribution is assigned to the cost impact, and

a schedule duration impact or duration distribution is assigned to the affected activity in the

schedule. Depending upon the software modeling program being used, the percent may need to

be within a specified range. A variety of probability distribution shapes are available for

modeling cost and schedule risk, including triangular, lognormal, beta, uniform, normal

distributions, etc. Definitions and a more thorough discussion of the various distribution shapes,

and their applicability, are available in Chapter 14 of the GAO Cost Assessment and Estimating

Guide, March 2009.

In general the basic concept is implemented as:

EV = ∑P

Ri

x CI

Ri

(or SI

Ri

)

Where: EV = Expected Value of cost impact (or duration impact) of all risks

P

Ri

= Probability distribution function of a risk occurring

CI

Ri

= Cost Impact distribution function of a risk occurrence

SI

R i

=

Schedule Impact distribution function of a risk occurrence.

[Note: ∑ is not the summation of individual expected values for each risk, but

represents a stochastic process (e.g., Monte Carlo simulation) using the collective

probabilities and cost/schedule impacts for all identified risk events.]

Inputs for the calculation include, but are not limited to:

Risk Register.

Historical records (especially where similar risks were handled).

- Actual costs.

- Time impact.

Subject matter experts.

- Delphi techniques.

- Interviewing staff, crafts, retirees, and others familiar with similar work efforts at the

site or other sites.

22 DOE G 413.3-7A

1-12-2011

Technical records such as safety analysis documents including the risk and opportunity

assessment, quality assessments, safeguards and security analyses, and environmental

assessments.

As information is gathered and finalized, it should be reviewed for bias and perception errors.

These findings should be captured in the analysis that accompanies the Monte Carlo simulations.

Consideration should also be given to the success of the identified risk handling strategy and

how the potential failure of the handling strategy will be reflected in the risk impact modeling

strategy. The preferred method for analyzing this risk could be to explicitly include the

probability of mitigation success in the quantitative analysis (See Section 4.3.5, Risk Register).

Another item that should be considered in this analysis is a review of any project constraints that

may impact the cost and schedule ranges assigned to the risks. Examples of project constraints

include the bounding assumptions identified in the risk management plan and/or risk analysis,

which might limit the impact of certain risks. If some of the bounding assumptions are unrealistic

and introduce risks to the project, then these risks should be included in the risk analysis. While

some of the constraints may be hard to measure, they should still be captured, for significant

risks, in the text of the analysis so that the risks are considered as they make decisions regarding

the future handling of the risks and any contingency requests or management reserve

applications.

The inputs into a Monte Carlo simulation process are normally continuous probability

distributions; however discrete probability distributions can also be used, where the need for

distinct values can be described. The most common methodology is to use a cost and schedule

range, expressed as the optimistic view, the most likely view, and the pessimistic view of the

impacts. However, if no central tendency exists for a distribution, a two-point estimate could also

be used.

For schedule impact evaluation, the logic-linked project schedule should be utilized as input to

allow the random sampling process to be tied to the critical path analysis. The project schedule

should contain sufficient logic linkage between the activities to clearly identify critical path and

near-critical path activities. The Monte Carlo simulation process simulates the full system and its

variables (risks) by random sampling the variables many times from its probability distribution.

Each time it develops a modified duration for each risk-related task or activity and determines

the project length based on the re-analyzed critical path. The results of the independent system

realizations are assembled into probability distributions of possible outcomes. As a result the

outputs are not single values, but probability distributions. A similar process can be executed for

cost using the project cost estimate or a detailed cost loaded schedule. Both threats and

opportunities should be analyzed.

While the use of the Monte Carlo simulation is one of the standards of the DOE/NNSA, it does

not mean that other forms of quantitative analysis are discouraged. Other forms of quantitative

analysis may be used. Suggested other forms of quantitative analysis that may be considered are:

decision trees, influence diagrams, system dynamics models, neural networks (see Attachment

15, Glossary, for definition of terms), and others.

DOE G 413.3-7A 23

1-12-2011

4.3.6.2.2 Additional Points of Analysis That Should be Included

The purpose of providing the additional analysis is two-fold. First, simulation graphs should

be supported with assumptions and data input (cost and schedule ranges, and probability

distributions) captured for each risk, and sensitivity analysis conducted to provide the

necessary information to enable an increased understanding of a project’s risk exposure.

Second, it provides decision-makers with a basis to engage the project team in discussions

relevant to project risks.

4.3.6.2.2.1 Planning Assumption Validation Analysis

Analyses accompanying Monte Carlo simulation data, including graphs, should include the

review of assumptions that serve as the basis for planning the budget and schedule of the

project from which risks arose. Since assumptions have a basis in fact, but are not facts

themselves, they should ensure they are still operable and as accurate as possible.

4.3.6.2.2.2 Cost and Schedule Quantification Range Assumption Data - Gathering

Process and Validation Analysis

As the costs and schedule ranges are captured for each risk for input into the Monte Carlo

simulation runs, the assumptions that formed the basis for those ranges should be captured.

The risks that are input may include low risks. The reasons for capturing those assumptions

are to form an historic database for future projects, an historic database for the current

project, a reference to substantiate how the projected federal contingency or the contractor

management reserve/contingency was derived, and as a basis to determine the possible range

of error that may exist in the data upon which the Monte Carlo data is based.

4.3.6.2.2.3 Alternative Run (Sensitivity) Analyses

A project may choose to execute further Monte Carlo simulations beyond the overall

schedule and cost runs. These may include targeted runs pertaining to specific risks or key

risks and their effects on various planned activities or the overall project. Further groupings

of risks may be chosen and the affects simulated against the schedule and cost of the project.

Chapter 13 of the GAO Cost Estimating and Assessment Guide provides a more thorough

discussion of the benefits of sensitivity analysis, including the steps for performing

sensitivity analysis.

In choosing to make these runs, it is important to identify the correlation factors

(interdependencies and relationships between risks), especially when those have become

more apparent when the runs are done after the project has been in the execution phase for

several months or years. The constraints of how various risks or similar risks will impact a

project will demonstrate characteristics that can be identified and captured as assumptions.

While risks are independently identified in most cases, they operate within the confines of

the project and have interdependencies, relationships, both positive and negative, as well as

dependencies to other projects within the same program area. In other words, there are

defined relationships that should be explored. These relationships can give rise to other latent

risks or risks that have remained undiscovered to date until these systematic relationships are

24 DOE G 413.3-7A

1-12-2011

reviewed. Chapter 14 of the GAO Cost Estimating and Assessment Guide offers a relevant

discussion of correlation and interdependencies.

4.3.6.3 Project Learning Analysis

A section of the Monte Carlo simulation written analysis should focus on the incorporation of

project learning, or, in other words, lessons learned. If the project is new, this section may be

the transference of learning from other projects. If the analysis is an update of the Monte

Carlo simulation analysis, it should include learning from prior periods. This analysis should

include insight into how risks have thus far presented themselves, how accurate the

assumptions and estimations have been, how those assumptions may or may not impact the

simulation results, and any other observations that the team finds are relevant to the

projections. If the analysis represents lessons learned that are applicable to other DOE

entities, the learning should be distributed by submitting lessons learned.

In the quantitative analysis, one should discuss whether bias and perception errors could have

influenced the data. Such errors in regard to the incorporation of information from lessons

learned can arise from both an overly optimistic or pessimistic view of project status. This

view can result in a misunderstanding of the applicability of the lesson to the project in

question, caused by the bias of the project team to the lesson presented or by a variety of

sensitivities to the data. The results of reviewing the data and questioning of whether any bias

or misperception could have occurred should appear in the written analysis that accompanies

the data. This analysis is often best provided by independent subject matter experts.

In regard to the impact on the simulation results, the analysis should focus on the calculation

of the contingency values. The usefulness of this analysis is in the follow-on risk discussions

that occur during the monthly reviews of risks wherein the impacts of risks are reviewed

along with the various assumptions as lessons learned are applied. By bringing the learning

together with the analysis, the FPD and CPM are potentially better prepared for how risks

will react on the project or how handling strategies will potentially mitigate the identified

risks.

This process of applying lessons learned is also recommended for projects, which perform

only qualitative analysis.

4.3.6.4 Error and Variance Analysis

Depending upon the size of the project and data bank being entered for any given simulation,

it may be necessary to subjectively estimate extreme values to ―bound‖ the magnitude of

possible outcomes. If this case situation arises, it could introduce random errors into the

simulation, which could potentially impact the results. If this occurs, it should be disclosed

and any error or bias should be discussed, as well as any methodology—triangle distribution,

for example—used to reduce such an impact (see Attachment 15, Glossary, for definition of

triangle distribution).

Risk attitude, the position that can be stated or unstated that the organization holds towards

risk, is one factor that can influence how risk is handled and how values are assigned, and

DOE G 413.3-7A 25

1-12-2011

should be included in the analysis. For example, it influences how one views the ranges of the

values and whether future values are considered and how, when considered, they are bounded.

This line of reasoning should be a subject of group discussion in the analysis in an effort to

mitigate biases or estimating errors.

Given that most risk impacts are estimates, some error is expected, and the introduction of

some range of error should be discussed. Even though the values generated by the Monte

Carlo simulation may be carried to several decimal points, it is important to remember that

these numerical values are indicators, not absolute values.

One suitable methodology for analysis purposes is variance analysis. Generally, variance

analysis is a tool that is used once the project has been under way for a period of time and has

some data from which the project manager and subject matter experts can use for determining

the expected values that are used to calculate the variance analysis.

Quantitative and qualitative analyses serve as the foundation for continuing dialog about

future risk realizations and the need for the application of the contingency and management

reserve. The written analysis that is derived from the quantitative and qualitative analyses

should address how policy has impacted the outcome of the data; the evaluation of the

reliability, software relevant issues, other variances which may have been introduced, how a

pattern has been applied, what it is and what choices were made to remain consistent in the

application thereof and the impact. The benefits of this approach, relative to other potential

approaches, should be addressed.

4.3.6.5 Contingency Adequacy Evaluation

Numerous tools exist to analyze the adequacy of the contingency valuation that has resulted

from the qualitative and/or quantitative analysis of the risks. Various cost estimating guidance

documents have been compiled by industry and are available in texts and journals (e.g. such as

the Association for the Advancement of Cost Engineering International), and are updated on a

regular basis. These references provide percent ranges of the base that a contingency should

represent in order to be considered adequate. Further, the contingency value should be

commensurate with the maturity and type of the project, project size, and risks, including

technical and technology uncertainties. It should be cautioned that the recommended

contingency levels in these documents do not provide a basis for the recommended confidence

levels (70 – 90 percent) in this Guide for the derivation of contingency and management

reserve by quantitative risk analysis.

If a quantitative risk analysis will not be conducted, estimates for cost contingency and

schedule contingency should be provided. As a general rule, the project should use various

inputs to determine those values. Those inputs may be, but should not be limited to:

Historical records.

- Actual costs.

- Time impact.

26 DOE G 413.3-7A

1-12-2011

Subject matter experts.

- Delphi techniques.

- Interviewing staff, crafts, retirees, and others familiar with similar work efforts at the

site or other sites.

Technical records such as safety analysis documents including the risk and opportunity

assessment, quality assessments, and environmental assessments.

As the information is gathered and finalized, the data should be analyzed for bias and perception

errors. While the data will not be systematically used for a quantitative analysis, it should still be

analyzed and perceptions scrutinized.

Note: It is suggested that the project’s initial estimated total cost and schedule contingency

should exceed the amount estimated to account for the known risks, in order to plan for the

potential cost of handling unknown or unpredictable risks that may manifest themselves during

the project life cycle.

4.4 Risk Handling

Risk handling covers a number of risk strategies, including acceptance, avoidance, mitigation,

and transfer. When weighing these approaches, the following should be taken into account:

The feasibility of the risk handling strategy.

The expected effectiveness of the risk handling strategy based upon the tools used.

The results of a cost/benefit analysis, i.e., how do the costs of the handling strategy

compare to the benefits derived from not realizing the risk event?

The impacts of the strategy on other technical portions of the project.

Any other analysis deemed relevant to the decision process.

The risk handling strategies should be compatible with the appropriate DOE or NNSA office’s

risk management policy and the appropriate risk management plan.

Many parameters of the project can change over time that can impact the risk handling strategies

(e.g., scope of the project, available resources, internal and external environments, technical

advancements, et al.). Thus, risk handling should be an iterative process. One or more of these

items can change a step in a risk handling strategy, or even the complete strategy, which then

changes the cost and/or the schedule for implementation of the risk handling strategy.

Risk handling strategies should consider the probability and consequence of the risk and, if

deemed necessary by the risk owner, should allow for a back-up risk handling strategy that is

documented in the risk register. If back-up risk handling strategies are documented in the risk

DOE G 413.3-7A 27

1-12-2011

register, they should be documented at the same level of detail as the primary risk handling

strategy. Documentation at the same level as the primary strategy will ease implementation if the

primary risk handling strategy is deemed unsuitable or inadequate. Further, the cost and

necessary schedule for the back-up risk handling strategy should be calculated and noted in the

risk register.

The cost for the risk handling strategy for the primary risk should typically be included in the

baseline as direct project costs if the handling action will be performed (see further discussion in

the following paragraph). The process includes identifying the scope, cost, and schedule

associated with implementing the risk handling strategy, and assigning a unique work breakdown

structure number and activity to the strategy so that it can be tracked and monitored. The project

team should develop the risk handling implementation plans with the appropriate level of detail.

The project activities should include the detailed work plans (for whichever phase the project is

then in) with the associated budget and schedule identified in the project Work Breakdown

Structure (WBS). At the appropriate time in the project life (Critical Decision 2), the handling

actions become part of the project baseline.

Some project teams make the mistake of thinking that all handling costs should be part of the

project contingency. If the handling actions will be performed, then DO NOT include the costs

of these handling actions in the risk contingency [or contractor Management Reserve (MR)].

These are known, identified project work activities and need to be planned accordingly, and

included as part of the direct project costs.

However, if the handling action will not occur until some event that may or may not occur, e.g.,

a risk trigger event, then it is appropriate to assign those costs to project contingency (contractor

MR). If the triggering event occurs, then the project would process a change using the project

change control system, to take cost/schedule from contingency (or MR) and assign it to the

project handling activities. This latter approach is more the exception than the rule.

There may be occasions when a primary risk is not added to the baseline until a change control

action occurs, such as when it is predicted during a monthly project review or a review of lessons

learned.

Risk handling strategies should be regularly reviewed throughout the project life cycle for their

affordability, achievability, effectiveness, and resource availability as described in the reporting

requirements of the risk management plan.

If questions arise about a risk or its handling strategy’s potential impacts on the technical goals

and objectives of the project, a more comprehensive analysis should be conducted.

Major/Key risks should be analyzed to examine the inter-relationships between other risks, as

well as other projects. This could lead to common risk handling strategies. The specific method

of analysis may include:

Pictorial modeling.

Fish-bone diagramming.

28 DOE G 413.3-7A

1-12-2011

String diagramming.

―What if‖ analysis systems modeling.

Time-specific sequencing simulation modeling.

4.4.1 Acceptance

Acceptance as a risk handling strategy should be a deliberate decision and documented in the

risk register. Acceptance of the risk does not mean that the risk is ignored. The risk should be

included in the cost and schedule contingency impact analysis.

Examples of risks that might be accepted include: